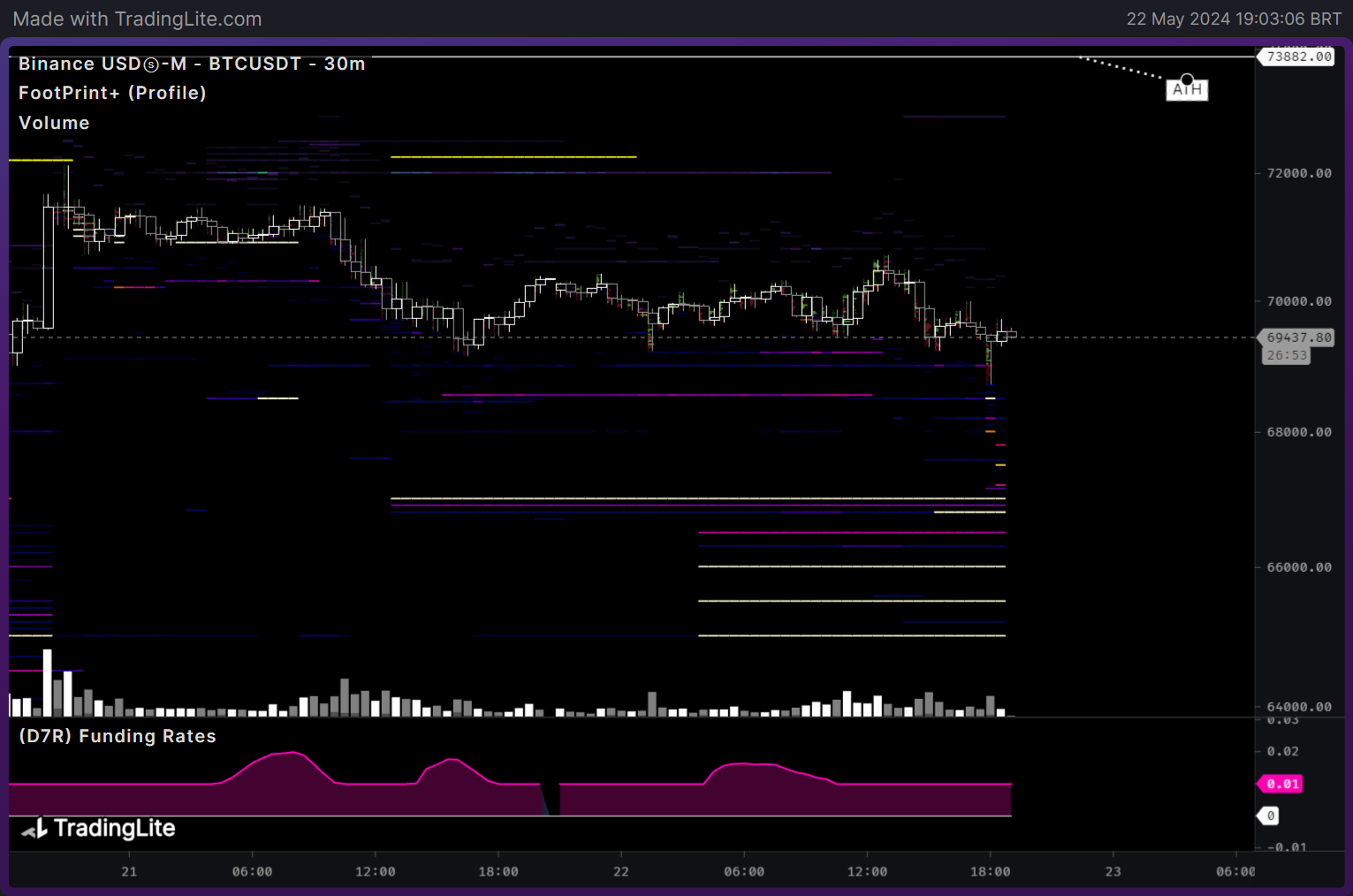

What is Trading Lite

TradingLite is a software designed to help people trade more efficiently. It provides real-time insights into market transactions and offers useful tools like technical indicators and order flow analysis. Users can customize the software using LitScript, a scripting language. It directly integrates with multiple cryptocurrency exchanges, making trading easier. The platform is user-friendly and accessible from any device, catering to both beginners and experienced traders with free and paid subscription options.

Trading Strategy with Trading Lite

To profit cautiously using the Liquidation Pools indicator, follow these steps:

Analysis of the Liquidation Heatmap:

- Identification of Critical Zones: Observe the colored areas on the chart. Zones with more intense colors indicate higher liquidity concentration, acting as “magnets” for the price.

- Understanding Market Dynamics: Know that the price tends to move towards these high liquidity zones because the forced liquidation of over-leveraged positions can generate significant price movements.

Risk Management:

- Setting Stop-Losses: Place strategic stop-losses to minimize losses if the market moves against your position.

- Don’t use Leverage: Leveraged traders are the most susceptible to liquidations. Our strategy consists of going against highly leveraged traders.

Continuous Monitoring:

- Real-Time Adjustments: Stay updated with the Market Makers’ orders.

- Quick Reaction: Be prepared to adjust your positions quickly in response to market movements.

Benefits and Precautions

TradingLite offers a unique advantage by allowing users to observe Market Makers’ orders to build their positions alongside them. Since Market Makers’ orders are typically large, they often act as barriers to prevent prices from continuing to rise or fall. This is because their orders are limit orders, while traders, who are usually highly leveraged, are buying or selling to them in market orders. This dynamic creates opportunities for traders to strategically enter or exit positions based on Market Makers’ actions.

Market Maker Orders on Trading Lite

Using the Live Analysis feature on Trading Lite, which shows market maker orders, can also be beneficial:

- Safer Trades: Market makers place large limit orders that act as support or resistance. Trading in alignment with these orders is generally safer, as they help stabilize the price.

- Order Book Insights: Observing the live order book can reveal where significant buy or sell orders are placed. If these align with Liquidation Pools, it provides a stronger trading signal.

Practical Application with other Indicators

Suppose you identify a high liquidity zone on the Liquidation Pools heatmap. Simultaneously, a sharp decline in open interest suggests a potential price movement. Observing Trading Lite, you notice market makers have placed large buy orders near this zone. This convergence of signals provides a robust indication to consider buying, with the expectation that the price will move towards the high liquidity zone, supported by the market maker orders.