Articles

Guide

DCA is an investment strategy that involves the regular purchase of assets at constant intervals. This helps to reduce the impact of market fluctuations in the long term, especially when dealing with an asset as volatile as Bitcoin. DCA lessens your mood swings and requires no monitoring of the market and prices.

- Reduces mood swings in the face of price volatility.

- Can take advantage of market opportunities as they arise.

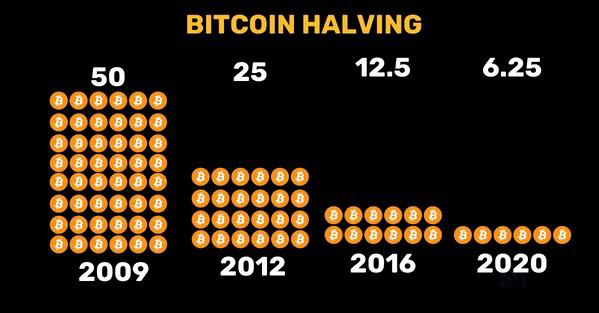

To ensure a gradual and limited supply of Bitcoins, the Bitcoin code introduced the concept of “halving”, which means periodically reducing miner rewards. This occurs every 210,000 mined blocks, about every four years. In 2012, the first halving took place, cutting miner rewards from 50 Bitcoins to 25 Bitcoins per mined block.

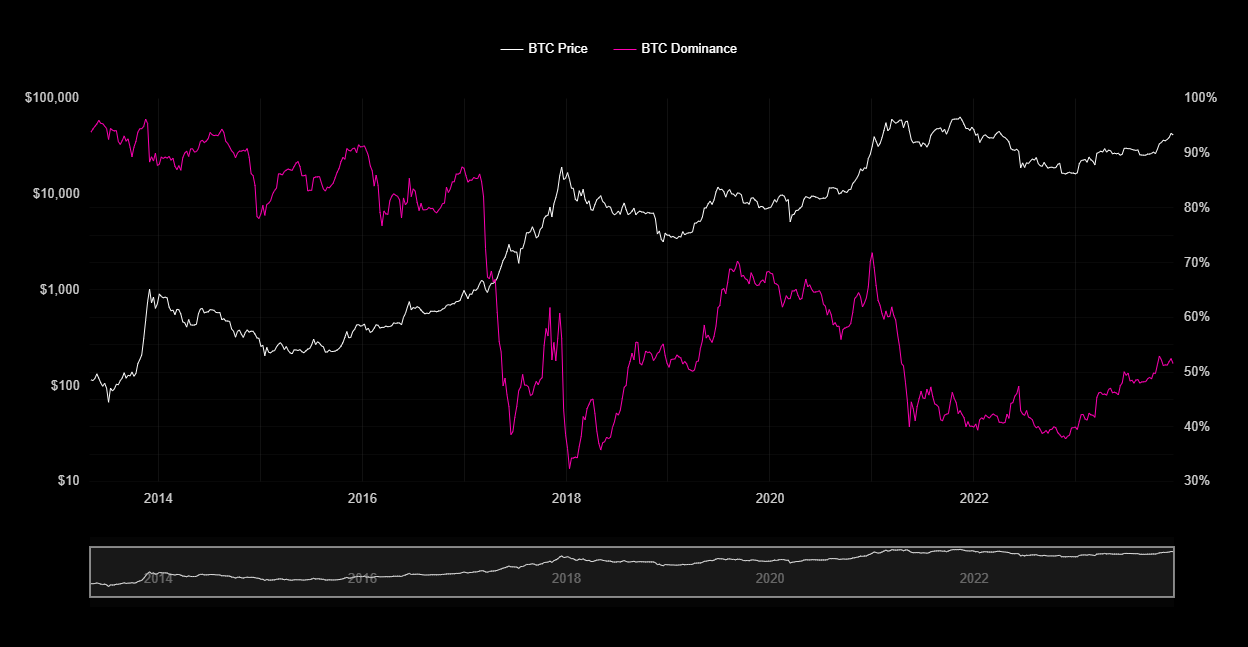

Bitcoin dominance, in straightforward terms, denotes the ratio of Bitcoin’s market capitalization to the overall market capitalization of cryptocurrencies. However, for those new to the cryptocurrency realm, it’s essential to grasp the significance of this metric and how it is applied.

The Bitcoin Funding Rate is a financing rate that traders pay or receive when trading Bitcoin futures contracts. If the funding rate is positive, traders who are buying pay this funding rate to traders who are selling. If the funding rate is negative, traders who are selling pay to those who are buying.

The NUPL indicator assists the investor in identifying which stage of the Bitcoin cycle they are in, which can be combined with the DCA strategy to take advantage of opportunities during downtrends.

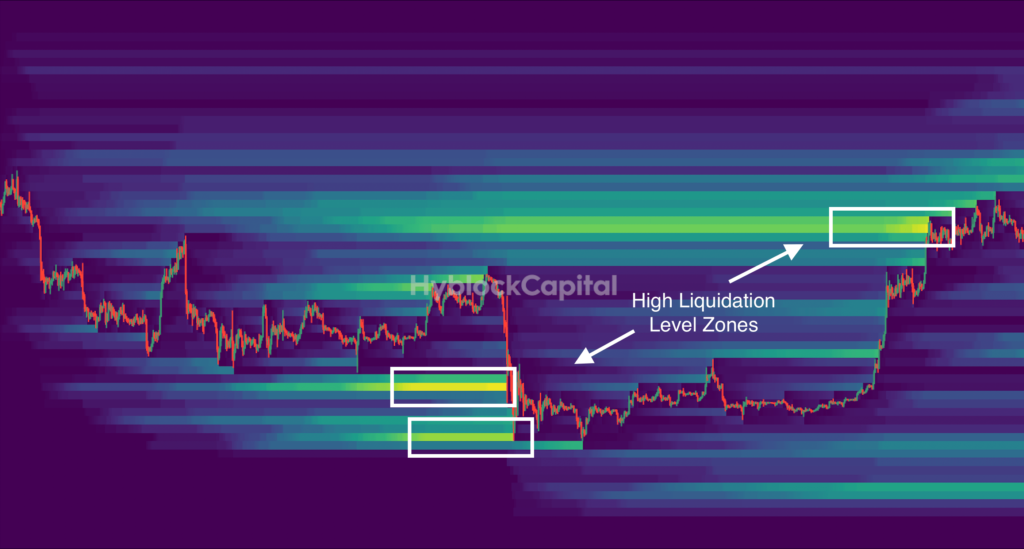

Liquidations primarily occur in the futures or margin trading environment and are triggered when traders’ positions are forcibly closed due to adverse price movements.

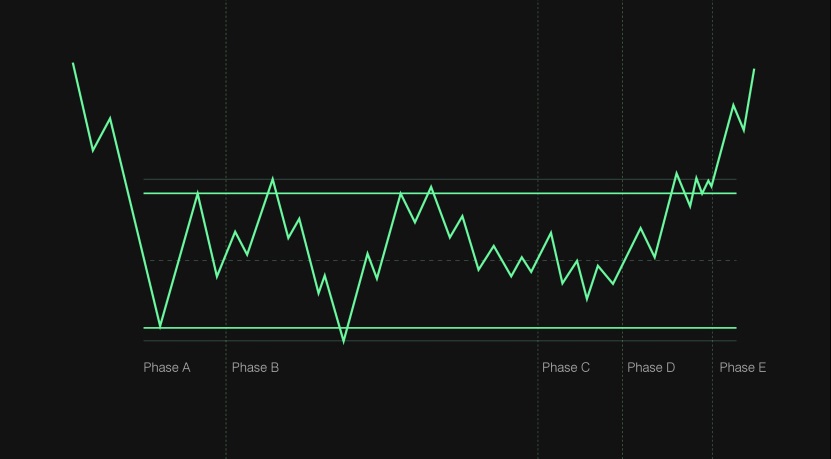

Price accumulations create well-defined support and resistance levels, forming what traders call accumulation zones. These zones represent a battleground between buyers and sellers. As the price bounces between these levels, it provides valuable information about market sentiment.

The colored areas that can be seen in the graph are the Liquidation Pools, also known as Liquidation Heatmap, where the liquidity within the market is represented with a heat map, which work as a magnet for the price. The Liquidation Pools are price zones, which indicate through a mathematical algorithm, where the over-leveraged traders could lose.

The extension offers users with a fast and powerful toolset for monitoring Bitcoin’s key indicators, such as price, Global Funding Rate, and NUPL, empowering them to make more informed and rational investment decisions.

Let’s see how prepared you are to face the CounterFlow Universe.

– 10 questions with 4 answer choices, only one of which is correct

– Topics cover Bitcoin and related areas beyond just the market

– Don’t take this quiz too seriously—have fun

– Correct answers will be shown after each question

CounterFlow Game-Quiz!