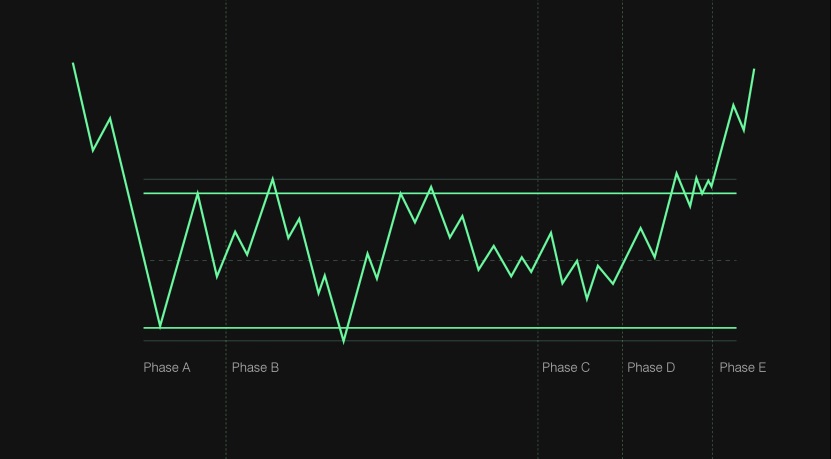

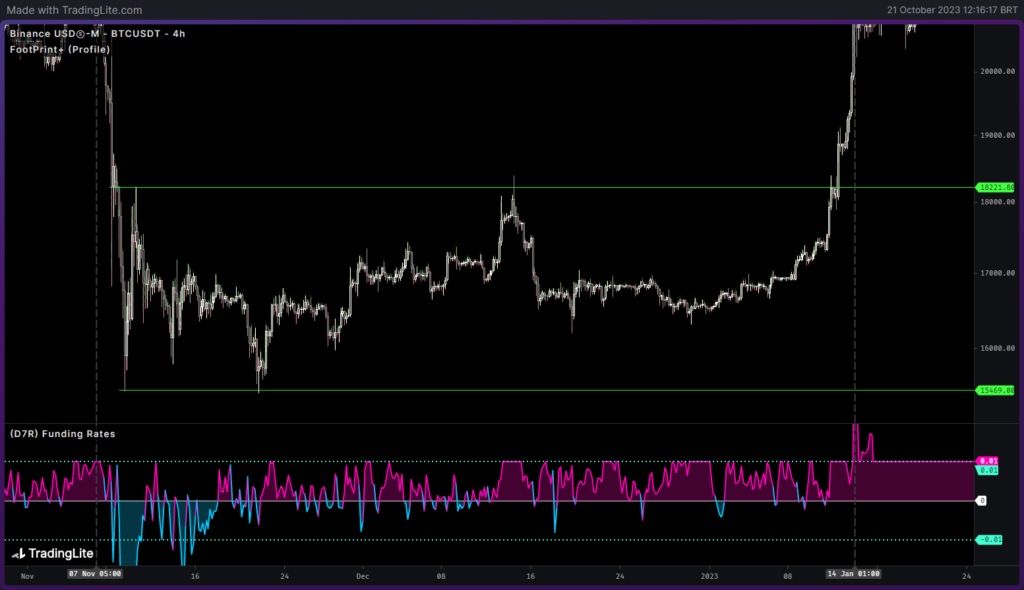

accumulations

Price accumulations in the Bitcoin market refer to periods when the cryptocurrency’s price consolidates within a specific range for an extended duration. These phases are often characterized by reduced volatility and trading activity. Understanding price accumulations is crucial for traders and investors as they play a significant role in shaping the subsequent price dynamics.

Accumulation Zones: Price accumulations create well-defined support and resistance levels, forming what traders call accumulation zones. These zones represent a battleground between buyers and sellers. As the price bounces between these levels, it provides valuable information about market sentiment.

Market Sentiment: Price accumulations can also influence market sentiment. For example, a prolonged accumulation period following a strong uptrend might cause bullish sentiment to wane, leading to a potential reversal. Conversely, a consolidation period after a downtrend could signal a potential trend reversal to the upside.

In conclusion, price accumulations in the Bitcoin market are critical periods that can influence the future price dynamics of the cryptocurrency. Traders and investors closely monitor these phases to identify potential trend reversals, breakout opportunities, and shifts in market sentiment. Understanding how accumulation zones form and recognizing the signs of a breakout are essential skills for navigating the Bitcoin market successfully.