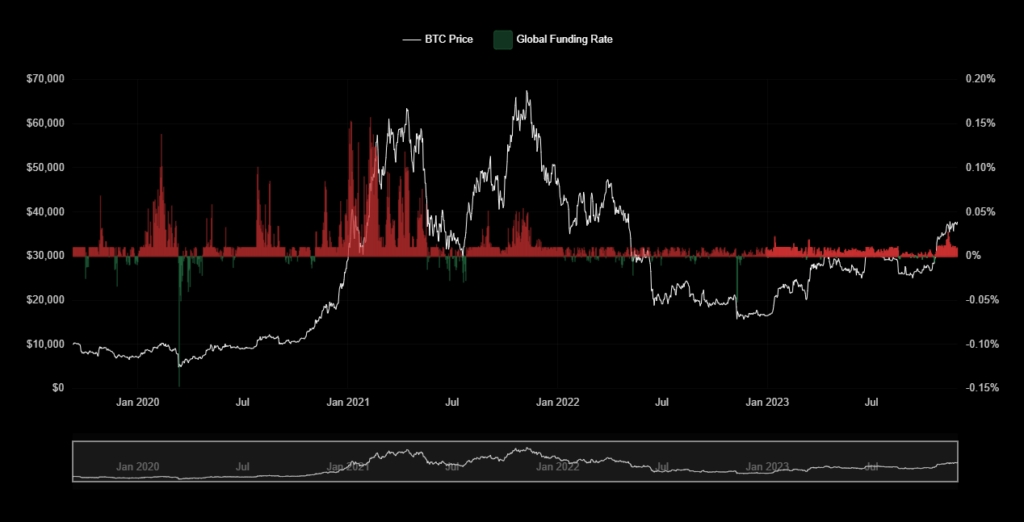

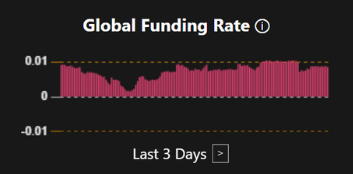

The Bitcoin Funding Rate is a financing rate that traders pay or receive when trading Bitcoin futures contracts. If the funding rate is positive, traders who are buying pay this funding rate to traders who are selling. If the funding rate is negative, traders who are selling pay to those who are buying.

The NUPL indicator assists the investor in identifying which stage of the Bitcoin cycle they are in, which can be combined with the DCA strategy to take advantage of opportunities during downtrends.

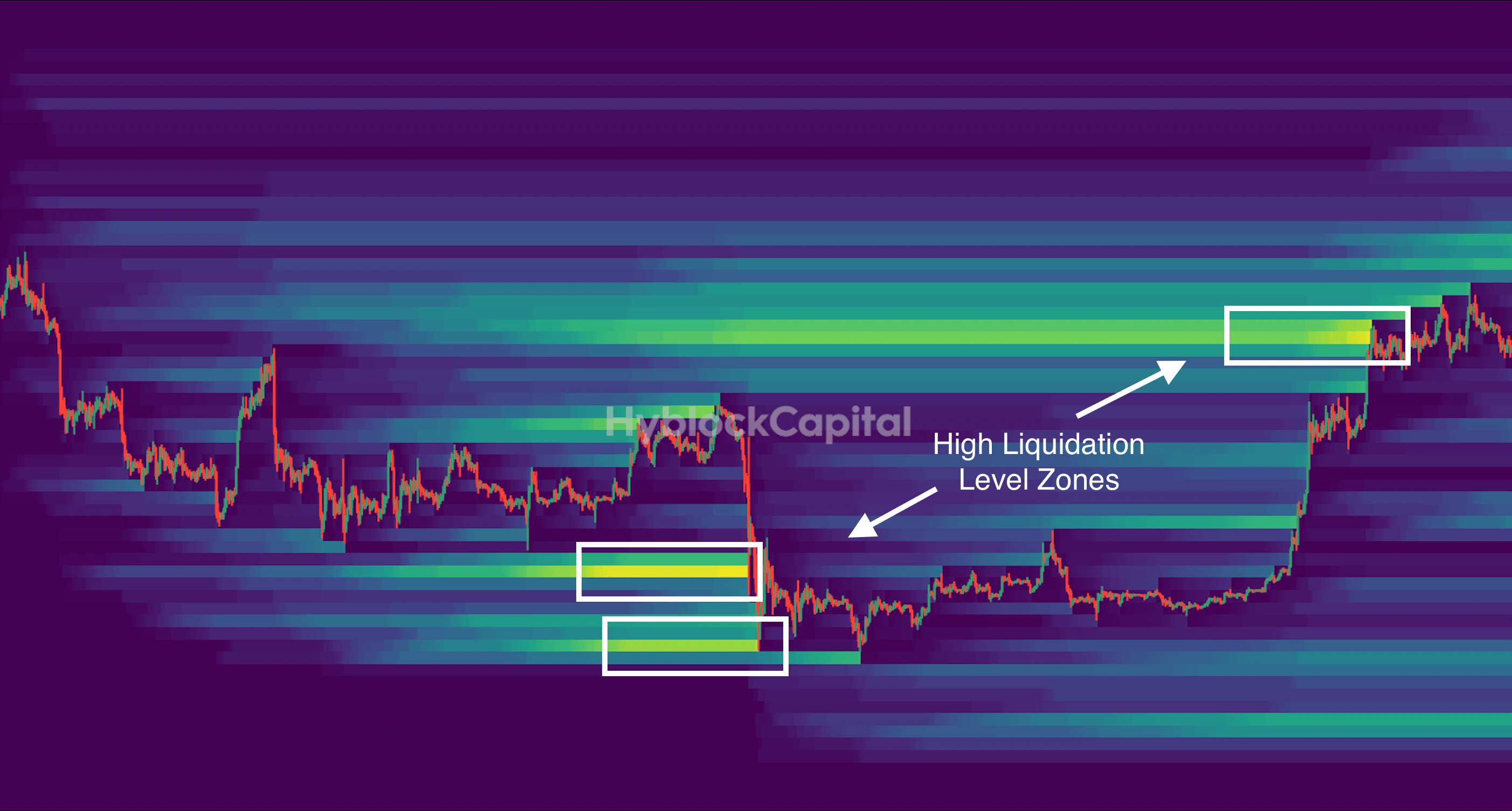

The colored areas that can be seen in the graph are the Liquidation Pools, also known as Liquidation Heatmap, where the liquidity within the market is represented with a heat map, which work as a magnet for the price. The Liquidation Pools are price zones, which indicate through a mathematical algorithm, where the over-leveraged traders could lose.